Have you been working from home? SARS has some good news for you!

Updated | By East Coast Radio

If you are an employee who has been working from home during lockdown you could be in luck.

Working from home during the pandemic was either all that or it was horrible, there really wasn't any in-between.

READ: WATCH: Plastic surgeon suspended after making TikToks with human flesh

But if working from home proved to be quite a struggle for you then this should cheer you up and make it seem worth it.

Usually, independent contractors and people who earn commission can claim home-office expenses for tax purposes, but since EVERY office turned into a home office during lockdown, you could also be making your claim!

READ: Meet Nora AlMatrooshi, the United Arab Emirates' first female astronaut

According to TaxTim there are a few requirements that are needed before you can submit your claim.

The requirements that you need to meet are:

- an office that is specifically equipped with everything you need to work from home (tools, equipment, and any other relevant instruments.)

- a letter from your employer stating that you did indeed work from home and they must also indicate the percentage of time you had spent working from there

- a part of your home that has been set up and used for work purposes exclusively

- having spent more than half of your working hours from home (working of course). An example would be if you started working from home in March (during hard lockdown) the minimum would be working until the end of September.

READ: Twitter furious after Enhle Mbali files restraining order against DJ Black Coffee

If you meet all these basic requirements you are well on your way to claiming for rent, use of data, water, electricity, repairs to your premises, and other types of expenses relating to your new home office.

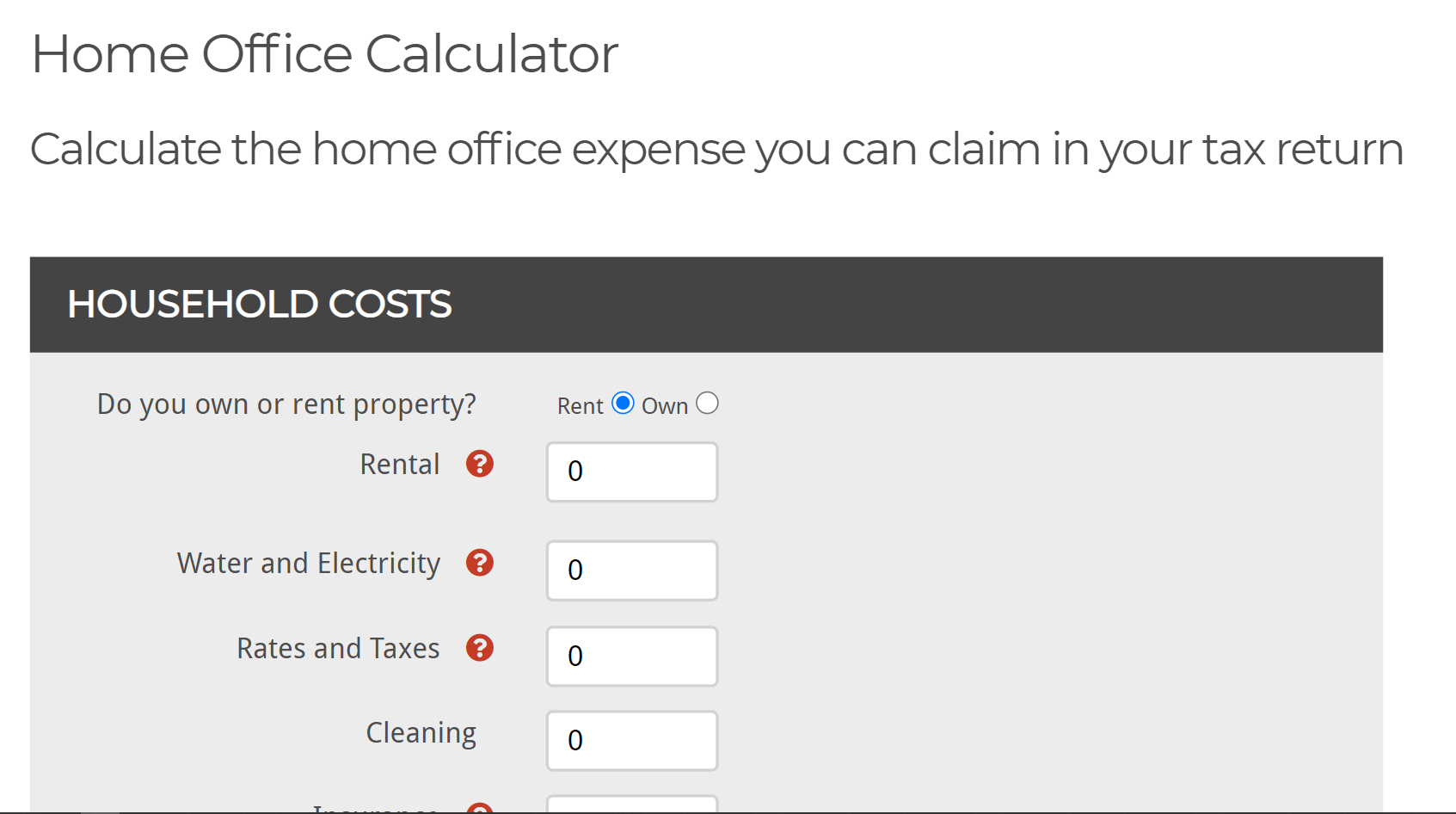

And you can use this TaxTim tax return calculator to help you figure it all out.

READ: WATCH: YouTuber opens a 10-year-old note for first time

All you have to do is: calculate the relation between the total square meterage of your home and the total square meterage of your home office. You will then use this percentage and apply it to your home office expenditure which will then calculate which portion of it is deductible.

It is also VERY important to note that you will need to add these claims to your tax returns manually because it will not be listed on the SARS automatic assessment!

READ: Top 20 hardest words to spell in the English language

Freelancers and sole proprietors you're in luck though: you can automatically deduct all your home office expenses and you do not have to meet these strict requirements in order to qualify for these deductions.

So there you have it!

Easy-peasy, or at least it seems easy enough.

READ: Green mamba at Sibaya construction site

2020 wasn't the most positive year but at least it seems like there is some possible good that could come from it.

And this does make doing taxes a bit more exciting.

For more of the best Darren, Keri, and Sky moments, listen here:

Main image courtesy of iStock

Show's Stories

-

Fashion for a cause: Durban SPCA's thrift fair

The Durban SPCA will be hosting a fashion extravaganza with Gecko Culina...

Stacey & J Sbu 14 hours ago -

uShaka Marine World reels in R14 Million lifeline

The eThekwini Municipality has reportedly approved a R14 million cash in...

Stacey & J Sbu 15 hours ago